Before 2006, Medicare did not cover prescription medications. There was a limited number of medications that were offered under Medicare Part Band, and otherwise, you had to pay for your medications out of pocket.

In 2003, everything had changed when President George W. Bush passed the Medicare Prescription Drug, Improvement, and Modernization Act (MMA). This is what we now know of as Medicare Part D, an optional part of Medicare that provides prescription drug coverage.

Part D plans are run by private insurance companies and not by the government. However, the federal government sets guidelines on what basic medications are covered and how much you can be charged.

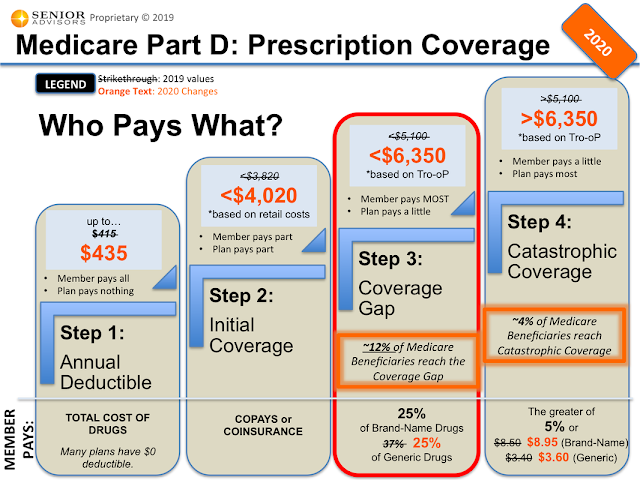

A deductible is the amount of money you spend out of pocket before your prescription drug benefits begin. Your plan may or may not have a deductible. The maximum deductible a plan can charge for 2020 is set at $435. It has increased by $20 from 2019.

Part D Premiums

A premium is the amount of money you spend every month to have access to a health plan. The government sets no formal restrictions on premium rates and prices usually rise every year.

That is not the case this year. In 2020, the basic premium for the minimum Part D plan is set at $32.74 per month, a decrease from $33.19 in 2019. Plans with extended coverage may even cost more.

Part D National Base Beneficiary Premium

Do not confuse the national base beneficiary premium (NBBP) with your monthly premium. Although the numbers could technically be the same, they rarely are. The NBBP is a value used to calculate how much you owe in Part D penalties if you sign up late for benefits. The NBBP is set at $32.74 in 2020, a decrease from $33.19 in 2019.

Part D Income-Related Medicare Adjustments Amounts

The government also charges you extra for Part D coverage based on your income. This is known as Income-Related Medicare Adjustments Amounts (IRMAA). You will pay monthly IRMAA to the federal government as well as monthly premiums to the insurance company. In 2018, IRMAA changed the categories of income so that more people would be required to pay a surcharge. In 2019, they added an extra income category. In 2020, they increased the income categories for inflation. If you do not pay your IRMAA in a timely fashion, your Part D plan could be canceled.

Mga Komento

Mag-post ng isang Komento